Resources

CONVERTIBLE EDUCATION

Definition of a Convertible

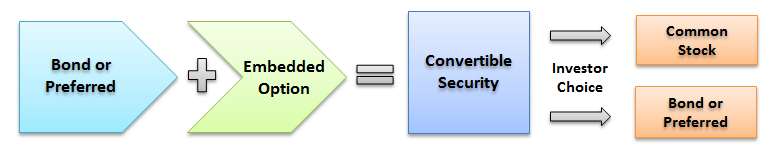

A convertible security is a corporate bond or preferred stock with an embedded option that allows the holder to “convert” the bond or preferred stock into a fixed number of common shares of the issuing company.

Like other corporate bonds and preferred stocks, convertible securities pay a fixed rate and convertible bonds have a maturity date.

Convertibles have the added feature of allowing the holder to convert the security into common stock.

Convertibles Derive Value from Two Sources

Equity Side

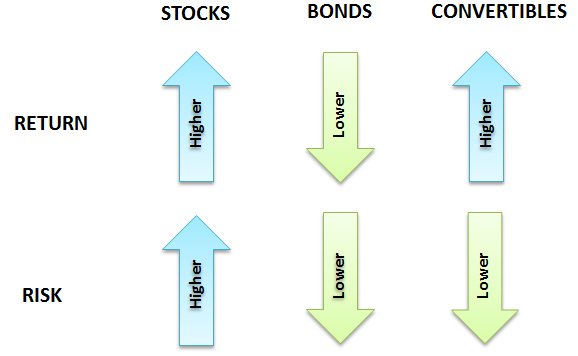

- The conversion value is the value of the common shares if the bond were converted today.

- Convertibles participate in upside appreciation of the underlying stock because of the conversion feature.

Bond Side

- The investment value is the value of the security if it were a straight bond without a conversion feature.

- Convertibles also provide a downside cushion because an investor can continue to collect the interest and principle if the stock declines.

Join our Distribution

United States

888 Seventh Avenue, 31st Floor

New York, NY 10019

United Kingdom

5th Floor The Dacre

19 Dacre Street

London SW1H 0DJ